31 Mac 2020 a Borang E hanya akan dianggap lengkap jika CP8D dikemukakan pada atau sebelum 31 Mac 2020. Penyata Gaji Pekerja SWASTA EA No.

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

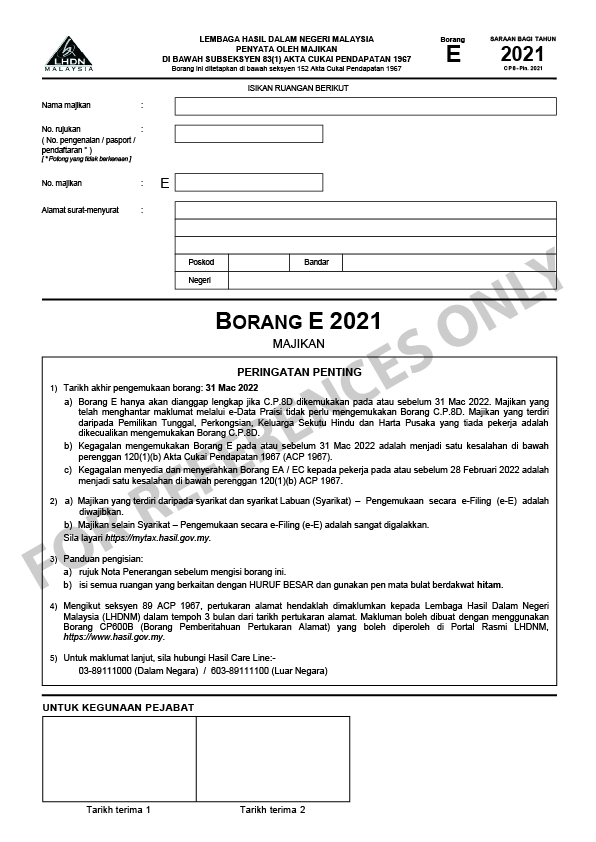

1 Tarikh akhir pengemukaan borang.

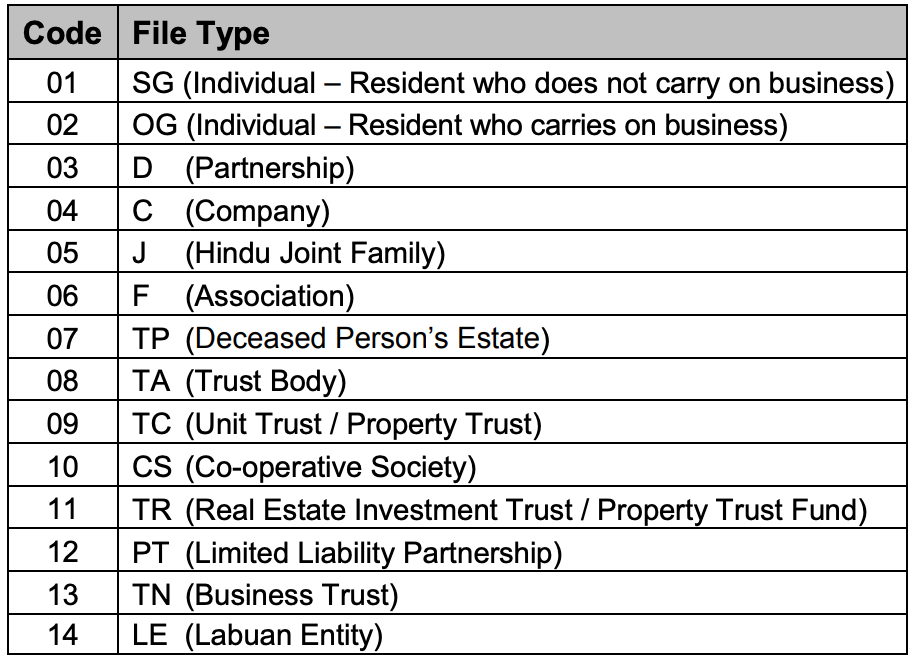

. Show posts by this member only. FORM TYPE CATEGORY DUE DATE FOR SUBMISSION E 2019 Employer 31 March 2020 BE 2019 Resident Individual Who Does Not Carry On Any Business 30 April 2020 B 2019 Resident. Monthly contribution form or form 8a in its physical form to employers beginning.

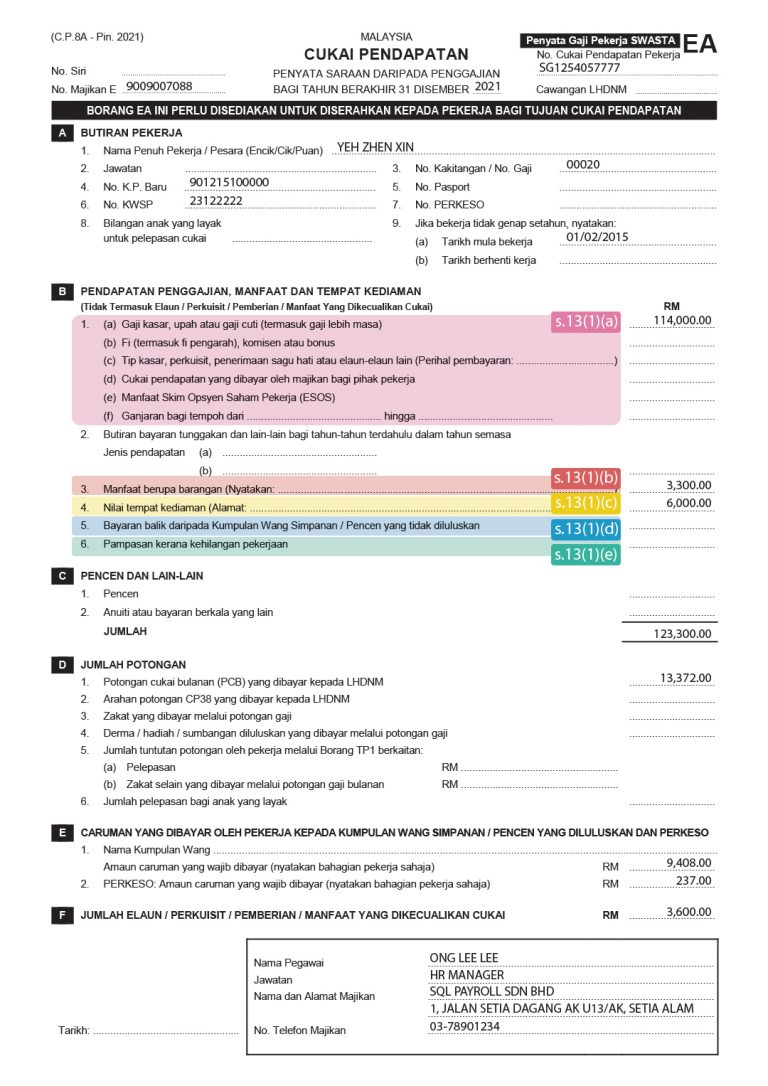

Borang EA adalah penyata gaji saraan setahun bagi pekerja-pekerja swasta. Registration contibution2 form benefits appellate form borang SIP2017 PrintEmail. Tambahan masa diberikan sehingga 15 Mei 2022 bagi e-Filing Borang BE Borang e-BE Tahun Taksiran.

The due date for submission of Form BE for Year of Assessment 2019 is 30 April 2020. 31 July 2019 until 31 August 2019 ree 3 months grace period from the due date of submission is allowed for those with accounting period ending 1 September 2019 until 31 December 2019. Due date for the.

As of 2022 the deadline for filing Borang E in Malaysia is. Commission fees statement prepared by company to agents dealers distributors. 1 Due date to furnish this form.

31 March 20 a Form E will only be considered complete if CP8D is submitted on or before 31 March 2020. Section 83 1A Income Tax Act 1967. All companies must file Borang E.

Tarikh akhir pengemukaan Borang BE Tahun Taksiran 2021 adalah 30 April 2022. Jumlah tuntutan potongan oleh pekerja melalui Borang TP1 berkaitan. Borang b 2019 due date.

The due date for submission of Form BE for Year of Assessment 2018 is 30 April 2019. Majikan yang aklumat melalui e-Data. According to the Inland Revenue Board of Malaysia an EA form Malaysia also refer to Borang EA EA Statement EA Employee is an Annual Remuneration Statement that every employer shall prepare and render to his employee statement of remuneration of that employee before 1st March in the year immediately following the first mentioned year.

Tambahan masa diberikan sehingga 15 Mei 2022 bagi e-Filing Borang BE Borang e-BE tahun taksiran. February 10 2021 Employers tax obligations such as filing of Form E and preparation of employees Form EA would be at the companys agenda. Tarikh akhir pengemukaan Borang BE Tahun Taksiran 2021 adalah 30 April 2022.

Cukai Pendapatan Pekerja Cawangan LHDNM. Failure to submit the Form E on or before 31 March 2020 is a criminal offense and can. Year end Borang EA and PCB 2ii Save as PDF.

In the event of any balance due the balance shall be paid onbefore 30 April 2019. Due date to furnish Form E and CP8D for the Year of Remuneration 2021 is 31 March 2022. Tax Filing Deadline Extension for Year 2020 Updated 28.

EA License Renewal Period Now Open Enrolled Agents with SSNs ending in 0 1 2 or 3 should renew their EA licenses by January 31 2019 to ensure processing before the. Form E is a declaration report submitted by every employer to inform the IRB on the number of employees and the list of employees income details every year not later than 31st March. Employers who have e-Data Praisi need not.

Due date to furnish Form E for the Year of Remuneration 2019 is 31 March 2020. April 30 for electronic filing ie. Issued to inform you.

The due date is on the last day of the 11 th month of the basis period for YA 2021 andor YA 2022. LoanStreetmy 9 Things to know when Doing 2019 Income Tax E-Filing. Borang ini wajib diberikan kepada setiap pekerja oleh itu kepada para.

March 31 for manual submission. Ia dipanggil borang EC oleh agensi kerajaan. Attach a letter of appeal that explains the changes you wish to make along with a copy of your e-form and all.

As an employer this will be your responsibility to ensure that the rest of your employees get their forms by the month of February every year. Basically it is a tax return form informing the irb lhdn of the list of employee income information and. Grace period is given until 15 May 2019 for the e-Filing of Form BE Form e-BE for Year of.

Borang ea 2021 due date. In accordance with subsection 83 1A of the Income Tax Act 1967 ITA 1967 the Form CP8A Form EA CP8C must be prepared and rendered to the employees on or before. Dec 18 2019 0627 PM updated 7 months ago.

What Is Form E Ea And Cp8d Employers Annual Tax Obligation Otosection

Confluence Mobile Community Wiki

Borang Tp1 The Lesser Known Tax Relief Form Your Employer Did Not Tell You About

Number 1 Business Software In South East Asia

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News

Form Be For Reference Only Pdf Lembaga Hasil Dalam Negeri Malaysia Return Form Of An Individual Resident Who Does Not Carry Business Under Section Course Hero

Understanding Lhdn Form Ea Form E And Form Cp8d

Malaysia Tax Guide What Is And How To Submit Borang E Form E The Vox Of Talenox

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

How To Get An Ea Form What Is Ea Form Is Ea Form Compulsory

Ea Form 2021 2020 And E Form Cp8d Guide And Download

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

How To Get An Ea Form What Is Ea Form Is Ea Form Compulsory

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

Lhdn Borang Ea Ea Form Malaysia Complete Guidelines

What Is Form E Ea And Cp8d Employers Annual Tax Obligation Otosection

Ea Form 2021 2020 And E Form Cp8d Guide And Download

What Is Borang E Every Company Needs To Submit Borang E Now Updated 12 3 2020 Tax Updates Budget Business News